Stronger every year

Since 2002, Caxton emerged as a pioneering start-up, simplifying and adding transparency for customers. We introduced the first currency card, and over 20 years later, we thrive with an unmatched reputation. Today, Caxton advances with Open Banking and SaaFS using our proprietary API, CXTN. Seamlessly move money with ease and security. From payroll to global transfers, FX, and more – manage all payments from one secure, user-friendly platform.

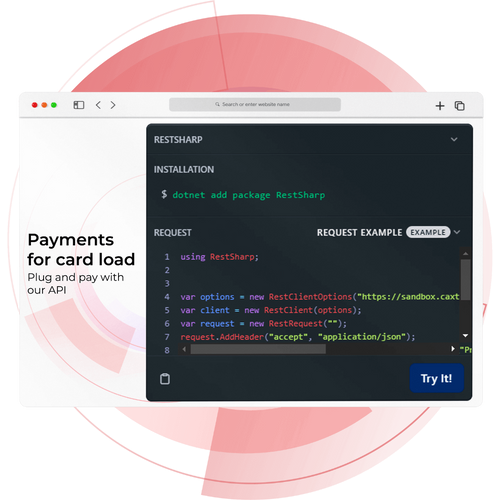

Our software

Experience financial transformation through our Software as a Financial Service (SaaFS) model. Seamlessly merge advanced tech and financial expertise for optimal results. Access a complete toolset to refine processes, boost decisions, and foster growth. Our powerful API ecosystem ensures smooth integration, cutting manual tasks and errors. Embrace innovation, reliability, and affordability for a new era of financial empowerment.